Targeting too broad an audience can lead to negative feedback and frustration, even to the conclusion that the product is bad and needed by nobody. This could be true, or it could be a situation where the product was offered to the wrong people.

In this text, I'll show the exact case of using a multi-criteria decision-making approach to segment the audience. I used Sales Navigator for identifying businesses, so the criteria and indicators are adapted for this tool.

In this text, I'll show the exact case of using a multi-criteria decision-making approach to segment the audience. I used Sales Navigator for identifying businesses, so the criteria and indicators are adapted for this tool.

PRODUCT CHARACTERISTICS

- Marketing: 1-to-many, not 1-to-1 sales.

- Work smarter, not harder: Product increases efficiency.

- Strategic core expertise: Focus on managing marketing effectively, not just performing tasks.

- Unconventional methods: Tends to suggest very new methods that could initially scare clients.

DECISION-MAKING FACTORS

To make a positive decision about purchasing this product, client should have:

- long-term focus, because strategy is needed only for long-term results. In the survival stage or in acute situations, people should focus on tactics and immediate results.

- need to increase efficiency.

- existing marketing team to execute efforts.

- need to find new ways to organize marketing or achieve goals, not just using existing methods.

- high risk tolerance to be able to consider unconventional ways.

CRITERIA FOR TARGET AUDIENCE

Now we need to convert decision-making factors into measurable criteria.

1. Long-term focus

For defining if the company focuses on a long-term perspective, I suggest using Churchill and Lewis's Growth Model. This model outlines five stages of small business growth, focusing on the challenges and requirements at each stage. According to this model, the long-term perspective first occurs at the “Success” stage when the company achieves stable income.

How to find companies at the Success stage using Sales Navigator:

1. Long-term focus

For defining if the company focuses on a long-term perspective, I suggest using Churchill and Lewis's Growth Model. This model outlines five stages of small business growth, focusing on the challenges and requirements at each stage. According to this model, the long-term perspective first occurs at the “Success” stage when the company achieves stable income.

How to find companies at the Success stage using Sales Navigator:

- annual revenue more than $2.5 million: on average, companies with less annual revenue are still in survival mode.

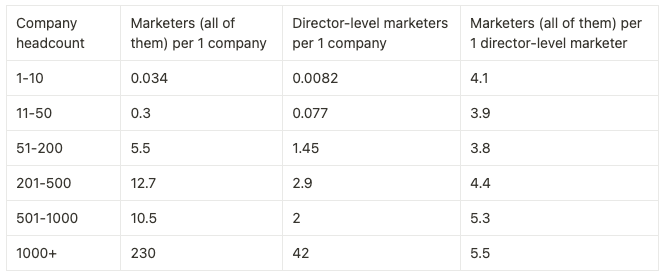

- headcount more than 50: according to Sales Navigator information (see the picture below), companies with less headcount have less than 1 marketer per company, but to have visible marketing efforts, they probably need some marketers.

- headcount annual growth of 5-15% is a moderate level of growth.

2. Need in marketing, not sales

To define if a company needs marketing, not direct sales, we can analyze the proportion of marketing staff in the overall headcount. On average, a high amount of marketing staff is 10% and more. Less than 5% would show very low attention to marketing efforts and, probably, that marketing is not a major source of sales.

3. Need to increase efficiency

There are a few signs that a company is focusing on efficiency right now:

For a moderate level of revenue per employee, I’d offer some basic methods to increase efficiency or create a basic system that would free up some human resources. But for a high level of revenue per employee, advanced methods are obviously needed, or they may not need them at all.

To define if a company needs marketing, not direct sales, we can analyze the proportion of marketing staff in the overall headcount. On average, a high amount of marketing staff is 10% and more. Less than 5% would show very low attention to marketing efforts and, probably, that marketing is not a major source of sales.

3. Need to increase efficiency

There are a few signs that a company is focusing on efficiency right now:

- not funded recently: companies shouldn’t be in fast-growth stages, as they prioritize growth over efficiency.

- moderate or high revenue per employee: Low revenue per employee may indicate operational inefficiencies, underutilized resources, or labor-intensive models, suggesting other priorities or a lack of strategic focus.

For a moderate level of revenue per employee, I’d offer some basic methods to increase efficiency or create a basic system that would free up some human resources. But for a high level of revenue per employee, advanced methods are obviously needed, or they may not need them at all.

4. High risks tolerance

This depends on two aspects:

5. Existing marketing staff

If a company already has stable income, they obviously can generate leads and purchases. So the company probably has the required marketing staff or the money to hire them.

6. Need to find new ways

This factor really depends on the personality traits and goals of decision-makers, so we can’t get such information from basic company info. We can analyze existing content and the semantics used in it, past decisions (how innovative they were), talk with the person and ask specific questions, but all of this is not the topic right now.

This is not the same as risk tolerance: one is the ability to handle unpredictability (risk tolerance) and another is the desire to try new methods.

This depends on two aspects:

- personal characteristics, which require deeper analysis than a basic search,

- the amount of available resources. The more resources to cover the negative outcome, the higher the risk tolerance. Companies still in the survival stage with unstable income are less likely to adopt unconventional methods.

5. Existing marketing staff

If a company already has stable income, they obviously can generate leads and purchases. So the company probably has the required marketing staff or the money to hire them.

6. Need to find new ways

This factor really depends on the personality traits and goals of decision-makers, so we can’t get such information from basic company info. We can analyze existing content and the semantics used in it, past decisions (how innovative they were), talk with the person and ask specific questions, but all of this is not the topic right now.

This is not the same as risk tolerance: one is the ability to handle unpredictability (risk tolerance) and another is the desire to try new methods.

CONCLUSIONS

All these statements are only a basis for hypotheses and need to be checked because they are made based on average information, so exact company info could differ.

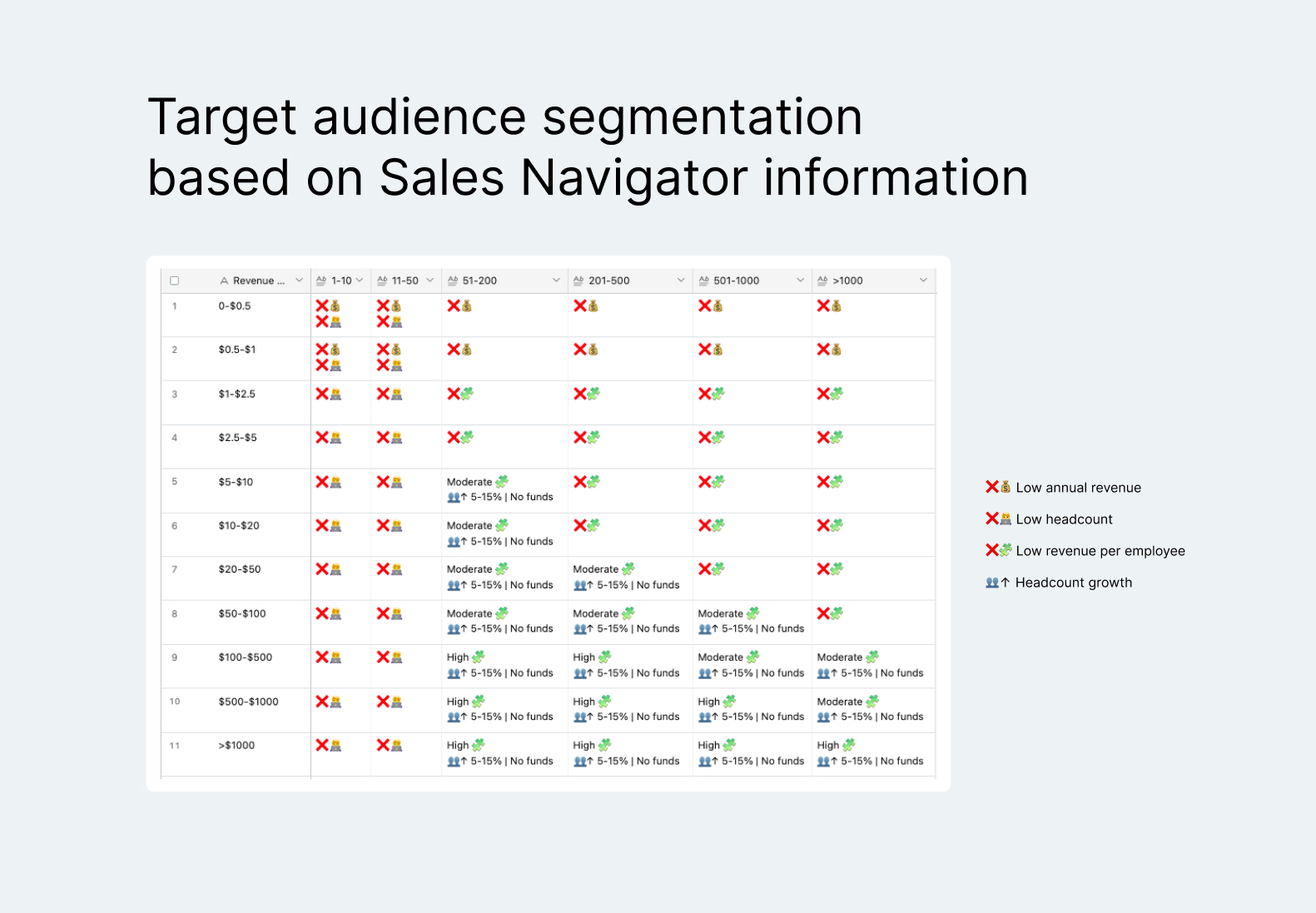

Resulting segmentation you can see in the attached picture.

Resulting segmentation you can see in the attached picture.